Abhay (Brian) Goel

Co-Founder

LogicApt Accounting Services stands at the forefront of global outsourcing, specializing in providing audit, tax, and accounting services. We cater specifically to growth-oriented accounting firms worldwide, aiming to bolster their evolution and expansion. By outsourcing with us, firms can optimize their staffing, allowing their teams to concentrate on higher-value tasks, thereby enhancing profitability and reducing operational costs through our delivery centre in India.

Service to International Accounting firms and the small and medium businesses in their accounting needs, which allows them to scale and grow in their respective fields.

LogicApt bookkeepers seamlessly integrate with your existing team, providing

outsourced bookkeeping services. Entrusting them with your bookkeeping tasks not only

lightens your workload but also optimizes efficiency and financial management.

LogicApt provides comprehensive services, handling the intricate workload for seamless

management. Outsourcing payroll ensures precision, compliance, and punctual payments,

liberating

internal resources and refining operational efficiency, easing administrative load, and

sharpening

focus on vital business areas. Our dedicated team ensures to get tied with the custom needs

of your

clients and each of these services is delivered with a focus on attention to detail.

Using our outsourced accounting expertise, you don’t have to worry about your client’s tasks, allowing your internal team to focus on strategic accounting work.Financial reports prepared by LogicApt offer detailed insights, aiding firms in assessing their clients' financial well-being. Entrusting financial reporting externally guarantees precise, timely reports, compliance, and valuable analysis, fostering data integrity and diverse viewpoints that empower strategic business decisions.

LogicApt provides comprehensive support tailored to accounting firms, assisting in

meticulous review preparation, addressing potential issues and

documentation maintenance. Specializing in external audit processes for global

accountants, LogicApt ensures precise financial statements that accurately reflect

an

organization's financial status, fostering trust and credibility among external

stakeholders.

Tax Season is the time when accounting firms, presenting an opportunity to maximize revenue

by

doing as many tax jobs as possible. However, it's also a challenging time as firms, CPAs,

and EAs rush

to secure the necessary seasonal talent to manage the influx of tax returns. While some

succeed in

quickly scaling their operations, others struggle to enhance productivity. LogicApt offers a

team of

re-evaluated tax preparers to augment your in-house capabilities, enabling swift scaling and

increased efficiency.

Our leadership comes from a team that consistently inquires, experiments, and confronts challenges to unleash exceptional results at every opportunity.

Dive into Vital Insights for Your Accounting Practice

The accounting industry is facing significant challenges, particularly in terms of growth and flexibility. They are investing most of their time in sifting the books and less on the higher benefit yielding exercises. In the midst of this situation, the job of a organization turns out to be progressively huge in terms of human intensive and time intensive tasks...

As the Software Industry continues to grow, the importance, visibility, recognition, and profitability of the SaaS sector are on the rise. Accounting for SaaS companies demands specialized knowledge, particularly in recognizing revenue, managing deferred revenue from customer contracts, and accurately recording cost of goods sold and business expenses...

In 2024, Accounting firms would be wrestling with a basic choice: whether to depend on interior review groups or connect with proficient review support administrations. It is becoming increasingly difficult for Accounting firms to find and keep skilled auditors, which directly affects their ability to effectively manage audit workloads and maintain high audit quality standards...

According to U.S. Bank study 82% of small businesses fail due to cash flow problems.Cash Flow Management plays a crucial role in the success of any Business. There are plenty of clichés out there when it comes to the importance of cash-flow. Cash is king and Cash flow is the lifeblood of any business. Most of the businesses confuse cash transactions and the business transactions....

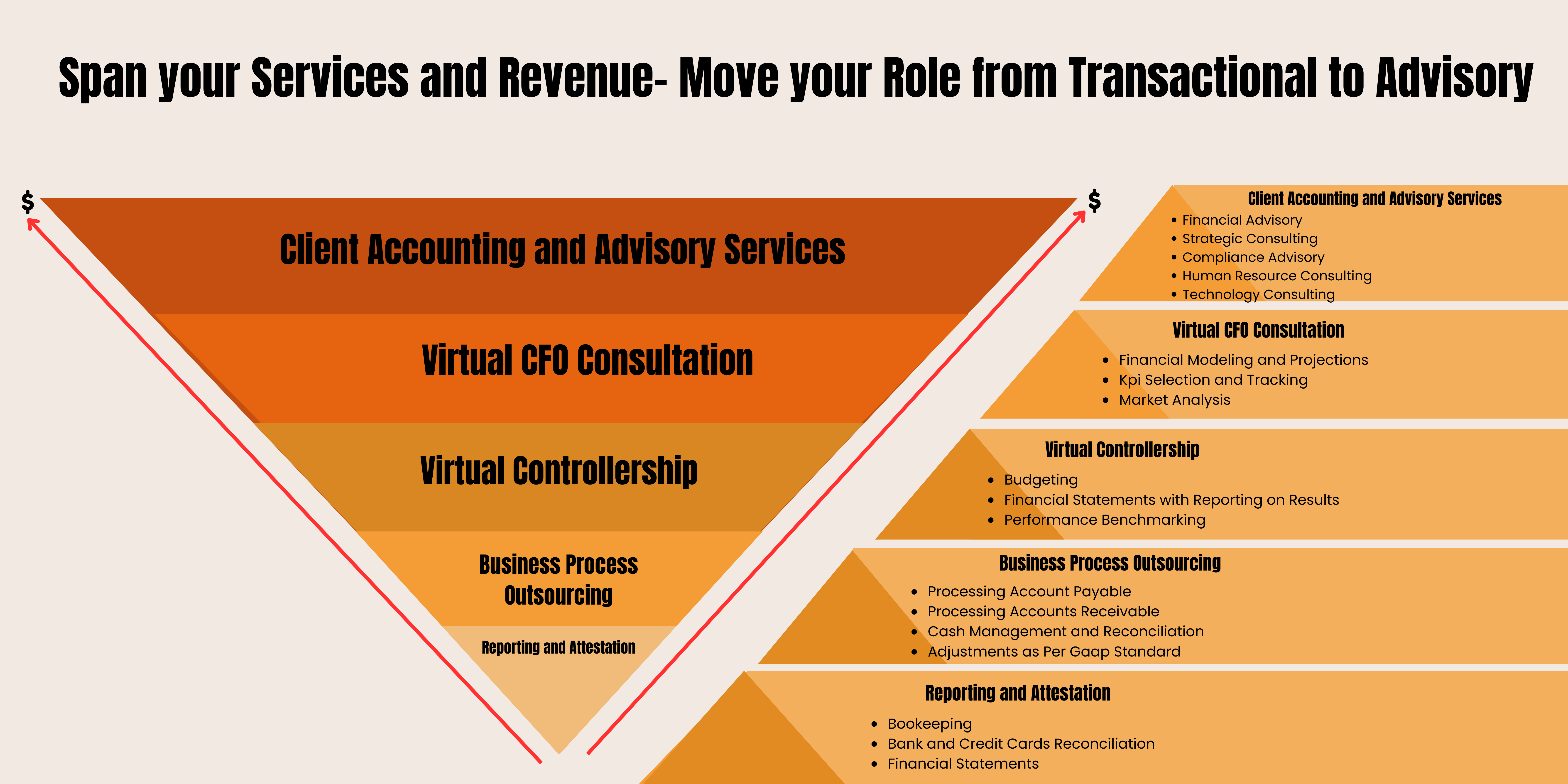

Why is client advisory services (CAS) is in high demand in the accounting profession today? In this dynamic world the businesses are growing very fast and they need help taking smart decisions faster....

Our offshore accountants have years of experience in using major accounting, bookkeeping, and tax software. We also work with the preferred software of your choice.

Monthly fees range from $1500-3500, all in. Our pricing is flat fee and billed on the first of the month for that month's service. The price is based on qualifications and experience. We charge only for accounting service whereas searching, sourcing, and equipment setup is free of cost.

Yes. They will work for you full time. Monday through Friday, 40 hours per week. On your time zone, if that's your preference. Technically your team member is not your employee as they will be on our payroll.

Yes, we are flexible and have customised models for all types of requirements. Part time is a 20-hour weekly commitment and Seasonal is a two-month minimum commitment.

Although we want firms to embrace their new team member culturally during on boarding to ensure the best chance for success but We do not bind our clients in case they do not want to continue with us. Hence, they can terminate the contract anytime with a minimum commitment of two months.

Yes. You can expect to get the same attitude, effort, and base knowledge that you would from an onshore accountant. Our delivery centre is in India. We have accountants, CPAs, EAs and CAs associated with us who have multiple years of experience in US Accounting. Our accountants have expertise in software that includes QuickBooks, SAP Business One, MYOB, Peach Tree, NetSuite, Xero, Creative Solutions, and others. We provide service to diverse client base.

We pre-screen candidates based on their Communication skills and proficiency in english Language along with the accounting knowledge.

In India, it is expected to provide two months’ notice to an employer before leaving. That’s why we inform firms to expect 6-8 weeks from making an offer to actual start date. Often times we have candidates available sooner as we maintain hiring pipeline through our sales projection. Also, if available, we can allocate an existing team member immediately.

We have dedicated IT team that specializes in offshore IT for accountants. As soon as the team members receive their new computers, the same are configured in compliance with the security protocol.

We work with all the clients either they use Cloud based applications or desktop applications/servers in a cyber-safe environment.

Yes we do offer a free trial of 10 hours, before signing the contract. It will give you a chance to check quality of our services and take the decision accordingly.