Australia

While we take care of all your time-intensive accounting tasks, you have more time to nurture client relationships and increase client retention. We provide immediate access to an experienced team of accountants trained to Australian accounting standards. The secure and flexible outsourcing model offered by us will help you scale your expert teams and bring cost efficiencies to the table.

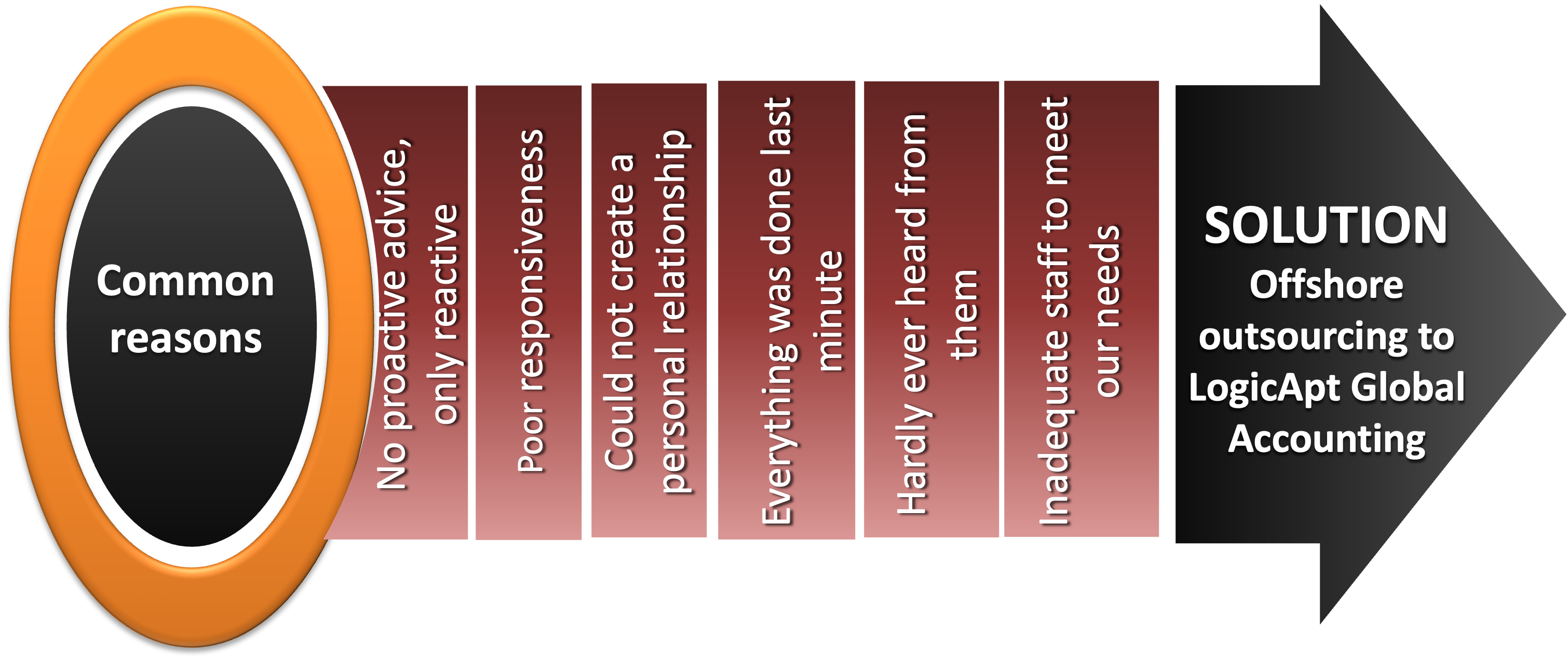

Why do SMEs switch professional service firms

Every action in the business drives

the numbers and the numbers can drive them.Accounting is a high stake, time consuming activity of recording all the

actions for any professional. We are sure no one became a founder of the company/ firm to put efforts in the tasks

that do not generate value for the client. However, these tasks are absolutely necessary.

Our role is to assist you with the day to day running and recording of all matters associated with your financial

records, payments of accounts, financial transactions, payroll, issuing of invoices, tracking and recording of any

outstanding debts, and ensuring you report accurately to the Australian Tax Office. Our team at LogicApt is abreast

with the latest accounting softwares to execute all the functions without any hiccups. This enables us to work with

our clients throughout the season- offering a real time , collaborative process that keeps the owners consistently

informed and up to date on financial health without drowning you in the details. We strategise to reduce your

operational cost and increase your bandwidth for strategic and customer satisfaction activities.

Benefits for Accounting firms

Few reasons why accounting firms should collaborate with us:

Cost Savings

Cost Saving upto 60% - With our fixed fees policy, you can save your operational expenses and enjoy the flexibility to scale services up or down.

Access to Expertise

Hire adequate and qualified resources, reducing the risk of errors

Staffing issues

Alleviate your in-house staff hiring, training and retaining challenges

Data security

Your data is our utmost priority to keep it safe with all the security, password protected credentials.

What We Do

Service to International Accounting firms and the small and medium businesses in their accounting needs, which allows them to scale and grow in their respective fields.

Bookkeeping

• Bank and Credit Card Reconciliations

• Entering Supplier and Customer invoices

• Tracking Inventory Items and maintaining the stock register

• Payroll Accounting

• Reporting

• Day to Day Bookkeeping

• Periodic Financial Reporting

• Software Integration and advise

Payrolls Processing

• Setting up Employee contacts for processing payrolls

• Processing Payrolls and Sending payslips (Weekly/Fortnightly/Monthly)

• Comprehensive payroll services

• Payroll Taxation outsourcing for accountants

Financial Reports and Review

• Statement of Activities - Income Statement or Profit and Loss Statement,

Cash Flow Statement

• Statement of Financial Position - Company’s assets, liabilities, equity and net

worth.

• Thorough analysis of income and expenses

• Ensuring reconciliation of all control accounts with statement balances

• Statement of Financial Position - Company’s assets, liabilities, equity and net

worth.

• Entry of workings into accounts production software

• Customized reporting as per business needs

Audit Support

• Excel to Electronic Migration: Facilitate the transition from traditional

excel-based

audit

files to

electronic formats for enhanced efficiency.

• Casting Procedures and Lead Schedule Agreement: Perform meticulous casting

procedures on

accounts to

ensure internal consistency, mathematical accuracy, and alignment with lead schedules in

final

accounts.

• Financial Statement Review: Thoroughly review financial statements of companies,

charities, and

trusts to ensure accuracy and compliance.

• Accounting Standards Compliance: Verify accounts against applicable accounting

standards

to

ensure

adherence to regulatory requirements.

• Error Reporting Checklists: Develop comprehensive checklists to identify errors and

discrepancies,

facilitating communication with the onshore audit team for necessary adjustments to

current and

future financial statements.

Tax preparation

• Finalization of Accounts & Preparation of taxation services for all entities

• Preparing and maintaining Depreciation Schedules & Asset Registers

• Preparation of workpapers ready for Audit

• Preparation and Lodgement of BAS (Business Activity Statement)

• Preparation of IAS (Instalment Activity Statement)

• Preparation of GST and PAYG

• Preparation of TPAR (Industry specific)

• Implementation of provision of Division 7A

• Franking Tax Credit

• Fuel Tax Credit

What We Do

- Bank and Credit Card Reconciliations

- Entering Supplier and Customer invoices

- Tracking Inventory Items and maintaining the stock register

- Payroll Accounting

- Reporting

- Day to Day Bookkeeping

- Periodic Financial Reporting

- Software Integration and advise

We employ the same tech as you

Our offshore accountants have years of experience in using major accounting, bookkeeping, and tax software. We also work with the preferred software of your choice.