Importance of Cash Flow Management

-

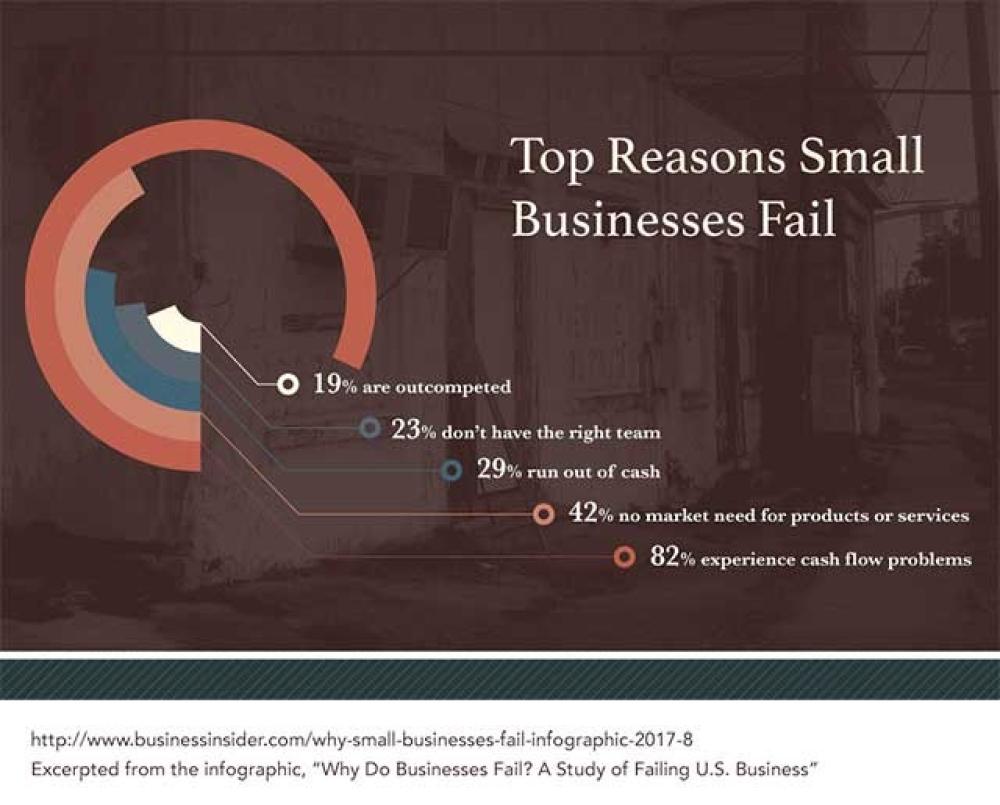

According to U.S. Bank study 82% of small businesses fail due to cash flow problems.

Cash Flow Management plays a crucial role in the success of any Business. There are plenty of

clichés out there when it comes to the importance of cash-flow. Cash is king and Cash flow is the

lifeblood of any business. Most of the businesses confuse cash transactions and the business

transactions. It is not necessary that they happen at the same time. Moreover, businesses also

confuse cash and profit. Therefore, strong cash flow management processes play a key role in

differentiating the businesses who succeed from those who fail.

Cash Flow Management plays a crucial role in the success of any Business. There are plenty of

clichés out there when it comes to the importance of cash-flow. Cash is king and Cash flow is the

lifeblood of any business. Most of the businesses confuse cash transactions and the business

transactions. It is not necessary that they happen at the same time. Moreover, businesses also

confuse cash and profit. Therefore, strong cash flow management processes play a key role in

differentiating the businesses who succeed from those who fail.

-

What is Cash flow?

1. Cash Inflows

The cash that flows in your business will come from clients. These are the installments as a trade-off for your items or administrations. At moments, there will also be inflow of cash not attached to the everyday business exercises, such as discounts, refunds, or installments got for the offer of hardware that has been considered outdated. Different inflows can emerge out of credits or different types of support. While projecting this inflow, keep the following points in mind:

· Predict the inflow based on the date when you expect the money will be reflected in your bank. You must account for this delay if a customer frequently pays late or in case any strategy for installment is being utilized by the client. Visa installments, or ACH exchanges are predictable items that should be sent to a lockbox.

· Repeating income streams are easier to anticipate than one-off exchanges. Any opportunity that can add this recurring income will help with more clarity in your business income.

2. Cash Outflows - Working Payment Disbursement

Most of it would come from everyday business activities related to your product and service deliverables. This would only vary from industry-to-industry; Variable expenses will fluctuate based on business activity, whereas fixed expenses will typically be the same amount month to month.

Fixed Costs:- Rent, utilities, insurance, leased equipment, professional services, and management and administrative salaries are typical fixed costs.

Variable costs:- It incorporates materials, supplies, and work costs related with creating and conveying your items or administrations. While projecting this outflow, keep the following points in mind:

· Predict the outflow based on the date when you expect the money would be expelled from your bank. In the event that you make early installments to enjoy any waiver or discount, consider this factor also.

· If the installments are being paid through cheques, keep an account for uncleared cheques that have not cleared the vendor’s bank.

Cash Outflows: Disbursements for Activities Other Than Operation

A few cash outflows activities like investments and financing are other than operation outflow. This includes repayments of debts, Capital expense and speculations for the business. Financing outflow primarily depends upon amount and frequency of payment and Capital investment depends upon business needs like assets for new hardware or offices.

3. Net Income and Credit extensions

Based on inflow and outflow, you will be able to project whether your net income is positive or negative. The probability is that you will have a little while, and a few months, where income is positive while different periods are negative.

It is essential to realize the cash peaks and valleys. It further helps in planning and forecasting by identifying recurring patterns and seasonal fluctuations. Having it forecasted, will play a crucial role in the decision of remaining or leaving the business.

This will further help you in taking advantage of a credit extension to cover a time of lower cash period.

Need of cash Flow Management

1. It tracks and coordinates a company’s past, present and future expenses.

2. It guarantees that an association is paying its solicitations on time, satisfactorily repaying staff with space for pay development, and overseeing assets for future ventures.

3. It offers a substantial comprehension of the manner in which income influences business, guarantee progress and expanded income rates providing an organization has full transparency into their funds.

Key to Management of Cash Flow

1. Keep an eye on and record cash flow.

You may find patterns in your current cash flow lifecycle and areas where your process could be improved by consistently tracking and analyzing the cash flow throughout your company using analytics, data, bank statements, and financial statements.

2. Forecasting Cash Flow

Projecting future financial inflows and expenditures for a firm is known as cash flow forecasting. Companies utilize this information to plan accordingly for both short- and long-term needs and to make prudent financial choices. Predictability will provide you with more control over your cash position.

3. Recurring Revenue

A steady income can help to offset seasonal revenue streams. Although, all businesses do not have the same opportunities for recurring revenue yet, any options for subscription-based revenue or maintenance contracts should be considered.

4. Managing Accounts Payable Efficiently using electronic payments

Managing cash flow primarily relies on streamlining the accounts payable procedure. Businesses may benefit from early-payment policy, establish a strong supplier relationship, and cut down on late payment process. There are some out there that will argue on it and rely upon using checks to gain an extra few days of holding onto your cash before the payment processes. This is an old game which needs extra management, and lack of visibility into which checks are still to be processed. This is the digital era. Not only are electronic payments more efficient to process, but also allow you greater visibility into when customer payments will be submitted.

Final thoughts

Get yourself a great Accountant, Having a well maintained spreadsheet is a backbone of financially well informed decisions. There is always a time gap between when you made a payment for stock, when the stock is realized and when the sales are made and when the payments will be reflected in your bank accounts. It is important to understand when cash transactions occur. This can be the single biggest pitfall for a business if they do not account for the timing difference. A simple cash flow forecast can help shed light on where trouble may lie. This can highlight key focus areas that you can then develop mitigation plans around. This accountant will always be ready with a crystal ball on the palm of hand which would reflect your figures.

Gains from hiring an Accountant

1. Quick Decision Making :-Cash flow, as the name suggests, the movement of money in and out of your business. At the highest level, a cash flow model tells us how much cash the business is generating or consuming and the timing of inflows and outflows. While important, there are other insights that you should be aware of this timing, which is critical for decision-making, as it helps to anticipate periods of surplus or shortage which would allow you to take the decisions judiciously.

2. Future Forecasting :- It further helps in planning and forecasting by identifying recurring patterns and seasonal fluctuations. Over time this will disclose the cycles being followed in the business. Consistent cash from operations is generally more sustainable than relying on frequent infusions from loans. This would allow you to understand your business and its future forecasting.

3. Making Strategies :- The quality of any activity is the primary concern of any business health. The cash flow model must differentiate between cash generated from various activities like core operations, investments, and financing activities. This would allow you to change your strategies accordingly.