-

Advisory Services: Transition of CPA Firms from Traditional Accounting practice to Client Accounting & Advisory Services

Why is client advisory services (CAS) is in high demand in the accounting profession today? In this dynamic world the businesses are growing very fast and they need help taking smart decisions faster. A 2020 survey by CPA.com revealed that advisory and consulting is clients' greatest unmet need, with 29% of clients saying they need this service. If price were no issue, 68% of clients would want their CPA firms to give them strategic consulting, the survey found, whereas 41% would want firms to manage some of their financial operations.

The need of Advisory service?

Firms that aren’t looking at the market need and are operating in the moment with the traditional methods are likely to miss out on important opportunities to grow. The driving factors for growth of Advisory market are as follows:

1. The increasing complexity of customizable reports and dashboards that allow clients to easily grasp trends, spot red flags and see new opportunities

2. The growing demand of financial planning & analysis to small and medium-sized businesses

A 2022 survey by CPA.com revealed that 79% said their CAS practice is part of a CPA firm while 95% for Top Performers, indicating that the top benefits of being part of a CPA firm contribute in part to CAS success. CAS is a new way for CPAs to differentiate themselves from the competition. Additionally, this serves as an opportunity for growth by having substantial source of revenue. Clients who do not use advisory services spend an average of $1,108 per month with their CPA firms, but clients who do purchase advisory services spend $1,585 a month, or 43% more.

What are Advisory services?

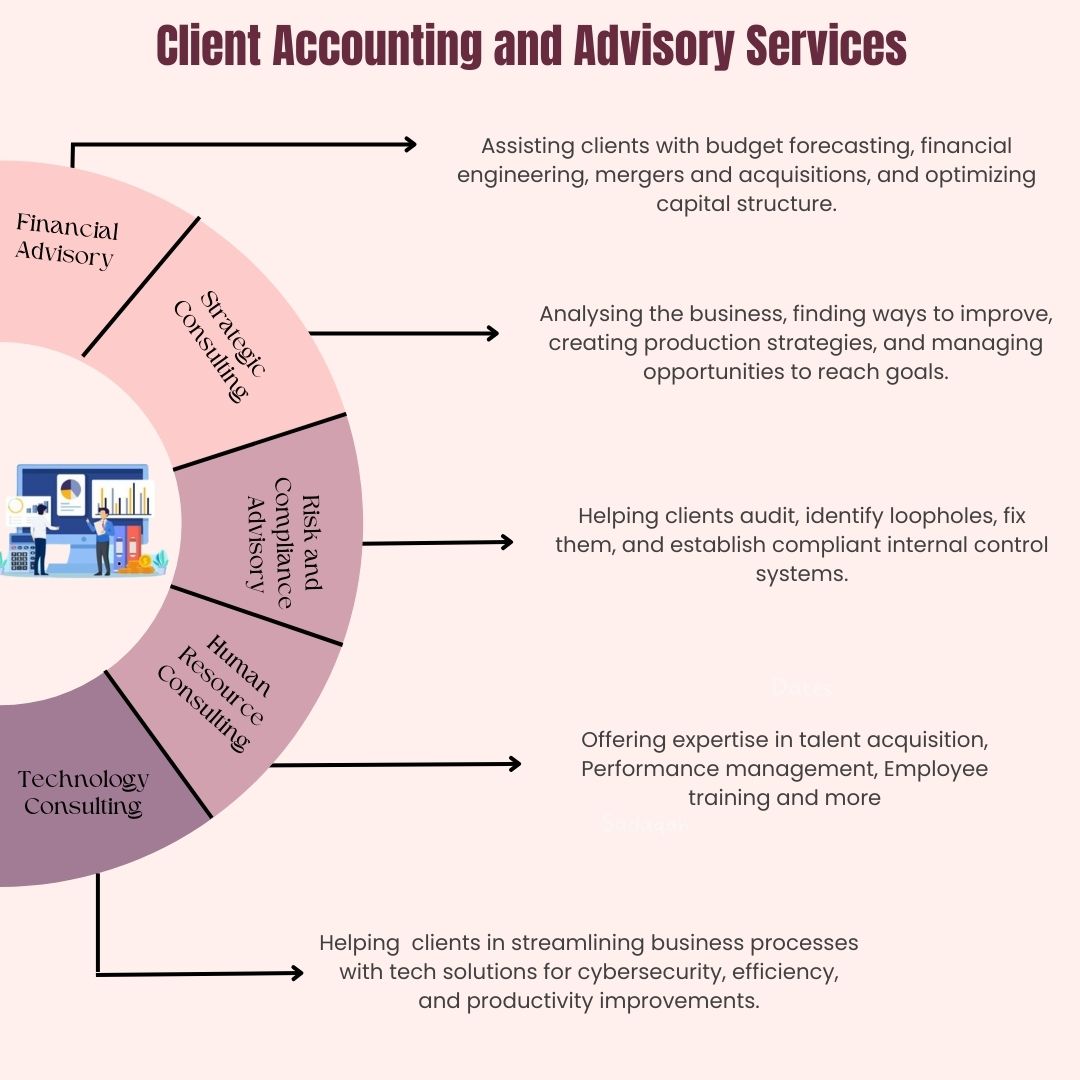

Advisory services typically involve in-depth analysis, research and collaboration with clients to understand their challenges and goals. This also serves as an opportunity for CPA firms to tap into new revenue streams, client relationships. The various Advisory services that can be covered as per the needs of the client are:

1. Financial Advisory – Helping client with budget forecasting, financial engineering, merger and acquisition, capital structure optimization etc

2. Strategic Consulting - Analysing the current state of the business, identifying areas for improvement, developing Production strategies and Opportunity management to help the business achieve its goals

3. Risk and Compliance Advisory – Assisting clients in auditing and identifying loopholes and helping in fixing it and establishing effective internal control system in compliance with various regulations.

4. Human Resource Consulting – Offering expertise in talent acquisition, Performance management, Employee training and development, Compensation and benefits etc.

5. Technology Consulting – Helping clients in streamlining the business processes by leveraging the technology solutions that can improve cybersecurity, enhance efficiency and productivity.

The AICPA and CPA.com define CAS as a practice where firms advise clients across a spectrum of financial and accounting related decisions, with the goal to deliver higher value and deepen the trusted advisor relationship. The most common offerings by CPA firms as CAS are:

1. 1099 creation and filing (91%)

2. Financial statement preparation (89%)

3. CFO/Controller Advisory services (88%)

4. Accounts payable (86%)

5. Sales tax returns (85%)

6. Consulting (financial planning and modeling) (83%)

7. Forecasting/budgeting (83%)

3 Reasons Accounting firms should offer client advisory services (CAS)

1. Defining the role of a trusted and strategic advisor- Clients do not need someone to write their history, but to forecast their figure that CAS can provide- After the Covid-19 Pandemic many clients got awake about the economic uncertainties and the value that CPAs can offer beyond compliance. For example, the staffing issue of Accountants being face by the businesses plague firms, which further forces to rethink that with short of number crunchers how can they provide Accounting and Advisory services. The clients can be offered quality services with a team of accountants, controllers and CFOs which enables them to have better internal controls with less risk and more strategic thinking. Outsourcing Accounting work can be a strategic move for CPA firms looking to shift their focus toward CAS.

2. Attract and retain the best people- Educate clients and firm staff on CAS and the value provided. a steady decrease in new students majoring in accounting, firms are facing a significant talent shortage. This shortage is a result of various factors, including voluntary resignations, the retirement of Baby Boomer accountants, and a lack of interest among young people due to misconceptions about the profession. By embracing CAS you can move from mundane accounting job to deciphering client’s data and help him in informed decision making. Over the period the team must have built industry specific expertise that can be utilised to identify strong clients that can be benefitted from CAS.

3. Create sustainable relationships and revenue streams over the long-term - As accountants you are uniquely positioned to take leverage of your existing relationships, expertise and technology. Strong customer relationships are built on shared connections and they are to be nurtured regularly based on insights gained from client conversations and financial data. Considering the demand of services and scarcity of resources to deliver, the pricing strategies must evolve to reflect the value that would be added to the business. If practices are using existing hourly rates as the basis for subscription or value-based fees, they are almost certainly under-pricing. Higher fees will better represent the work being done and lower stress on fast-growing practices

Wrapping up

What if I tell you that CAS can be introduced by leveraging your current expertise, clients and technology and has the potential to grow your business trajectory exponentially without any investment. The 2022 tax Professional report by Thomson Reuters Institute, 95 % accounting firm leaders acknowledge that their clients seek additional business advisory services. Yet many small and medium sized firms shy away from adding advisory services due to perceived high costs, disruption and risks. With the understanding of clients’ needs and willingness to pay: CAS packages can encompass a range of critical services such as financial statement preparation, Cash Flow management, Transaction processing, Controller services, Virtual CFO services and business advisory; Clients appreciate such one stop platform and there you can charge your client on the basis of value you bring on the table and not on hourly rates. Outsourcing the compliance work will help you maintain workload balance by streamlining the operations, increasing the efficiency and reducing the overhead costs. This will help you creating time for the attention that Advisory services deserve. By harnessing the power of outsourcing, you can move strategically and position your firm as a forward thinker in this dynamic market.