New Zealand

LogicApt is outsourcing provider of audit, tax, accounting and Payroll services to entrepreneurial growth-focused accounting firms. Our core purpose is to empower growth and transformation of accounting firms in NewZealand with our highly qualified team of accounting professionals. Our outsourcing services help in resourcing your practice effectively, free up staff to focus on higher-value tasks and drive profitability by reducing costs.

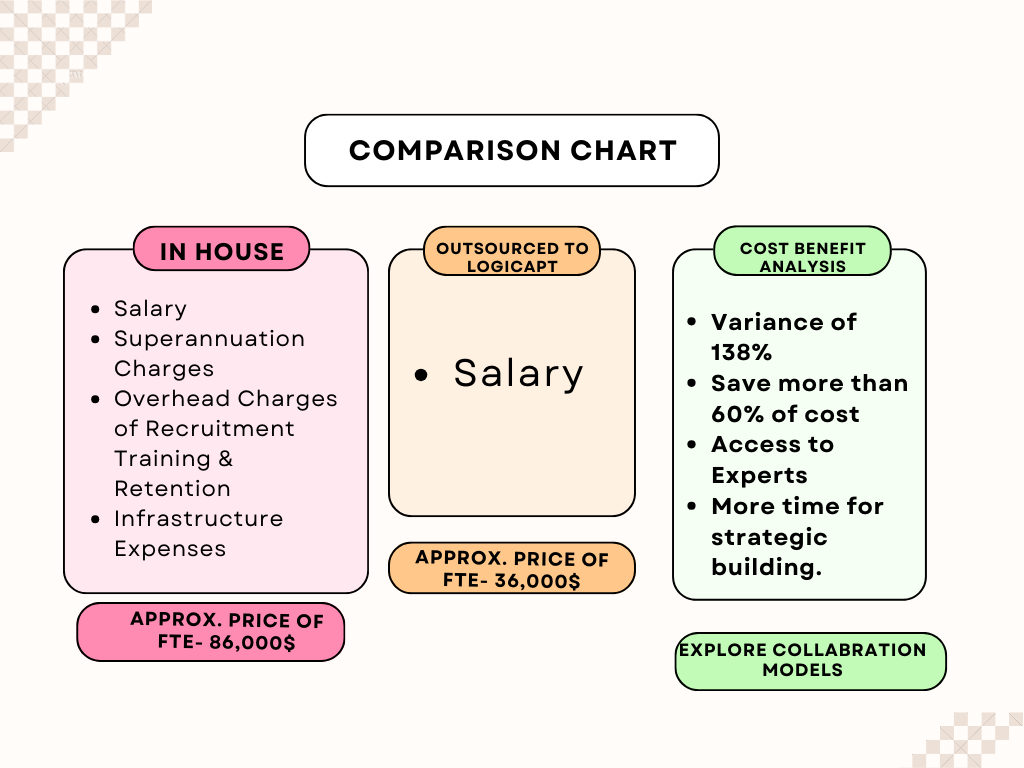

More than 60% Cost savings

Given the high-value peril involved

with financial errors & the underlying risk of penalties, the whole process of time intensive accounting can be a

daunting task for any accounting firm. We assist you to dodge such challenges with great ease through our

professional outsourcing services.

We are a team of professionals that collectively combine knowledge and experience to offer a cost effective and

Quality Business services. We aim to create time for you to do something that you are best at. Our services are not

limited by geography, offering remote accounting in any location through technology and cloud accounting software

applications.

We welcome you to contact us to arrange an obligation-free discussion to find out if we are a good fit for your

business and demonstrate how we can make a difference.

Benefits for Accounting firms

Few reasons why accounting firms should collaborate with us:

Cost Savings

We're not just number crunchers; we're your partners in profit, always ready with insights to help you in cost cutting and converting your fixed cost to variable cost

Focus on Core Activities

By entrusting your accounting tasks to experts, you free up valuable time and resources. This enables you and your team to concentrate on core business functions, driving growth and innovation

Scalability

Whether your business is in a growth phase or experiencing fluctuations in transaction volume, outsourcing provides the flexibility to scale services up or down according to your needs, ensuring cost-effectiveness.

Data security

Your data is our utmost priority to keep it safe with all the security, password protected credentials.

What We Do

Service to International Accounting firms and the small and medium businesses in their accounting needs, which allows them to scale and grow in their respective fields.

Bookkeeping

• Fundamental bookkeeping tasks

• Handling sales, purchase, and bank transactions, including expenses

• Maintaining the sales ledger control account

• Reconciling business bank and business credit card accounts

• Managing the purchase ledger control account

• Tracking Inventory Items and maintaining the stock register

• Payroll Accounting

• Periodic Financial Reporting

• Software Integration and advise

Payrolls Processing

• Setting up Employee contacts for processing payrolls

• Processing Payrolls and Sending payslips (Weekly/Fortnightly/Monthly)

• Comprehensive payroll services with thorough input of employee details.

• Payroll Taxation outsourcing for accountants

Financial Reports and Review

• Compilation of working papers, encompassing control accounts and lead schedules

• Thorough analysis of income and expenses

• Ensuring reconciliation of all control accounts with statement balances

• Statement of Activities - Income Statement or Profit and Loss Statement,

Cash Flow Statement

• Statement of Financial Position - Company’s assets, liabilities, equity and net

worth.

• Entry of workings into accounts production software

• Customized reporting as per business needs

Audit Support

• Excel to Electronic Migration: Facilitate the transition from traditional

excel-based

audit

files to

electronic formats for enhanced efficiency.

• Casting Procedures and Lead Schedule Agreement: Perform meticulous casting

procedures on

accounts to

ensure internal consistency, mathematical accuracy, and alignment with lead schedules in

final

accounts.

• Financial Statement Review: Thoroughly review financial statements of companies,

charities, and

trusts to ensure accuracy and compliance.

• Accounting Standards Compliance: Verify accounts against applicable accounting

standards

to

ensure

adherence to regulatory requirements.

• Error Reporting Checklists: Develop comprehensive checklists to identify errors and

discrepancies,

facilitating communication with the onshore audit team for necessary adjustments to

current and

future financial statements.

Tax preparation

• Meticulous preparation of business tax computation.

• Thorough self-assessment preparation for both individuals and partnerships.

• Finalization of Accounts & Preparation of taxation services for all entities

• Preparing and maintaining Depreciation Schedules & Asset Registers

• Preparation of workpapers ready for Audit

• Imputation Credit

• Preparation of GST

What We Do

- Fundamental bookkeeping tasks

- Handling sales, purchase, and bank transactions, including expenses

- Maintaining the sales ledger control account

- Reconciling business bank and business credit card accounts

- Managing the purchase ledger control account

- Tracking Inventory Items and maintaining the stock register

- Payroll Accounting

- Periodic Financial Reporting

- Software Integration and advise

We employ the same tech as you

Our offshore accountants have years of experience in using major accounting, bookkeeping, and tax software. We also work with the preferred software of your choice.